New Zealand - Payment Page Requirements

A guide to what is required on your payment page.

Before accepting any electronic commerce transactions over the internet, you must establish a website (approved by the merchant) which clearly displays the following information:

Your business trading name, which must correspond with:

the name that will appear on cardholder statements (you must state on your website what name will appear on cardholder statements)

the name advised on the payment record.

If the name of your website is different to your business trading name, it is especially important that your business trading name is prominently displayed so the cardholder can readily identify you as both the merchant and the name that will appear on cardholder statements.

Your legal business name (if this differs to your business trading name).

The physical address (including the country) of your approved place of business. A merchant that primarily operates from a personal residence must include the city, state/province, and country of its Permanent Establishment, but is not required to provide the residence address.

Your business and customer service contact details must include a telephone number or email address for customer queries, along with a secondary contact detail of the following:

facsimile number(s)

social media, such as Facebook, Twitter, Instagram

chatbot/chat box

A complete description of the goods and services available for purchase on your website with the price clearly stated in New Zealand dollars, or if you are using CurrencySelect, you may display the price clearly stated in a Bank of New Zealand approved foreign currency.

A clear statement that your business is a New Zealand business and that all transactions will be billed in New Zealand dollars, or if you are using CurrencySelect, you may indicate that transactions will be billed in a Bank of New Zealand approved foreign currency.

Details of your return/refund policies, cancellation policies, and other purchase terms and conditions, and a confirmation of acceptance of the terms and conditions upon customers' purchases. This can be achieved through either:

A 'click to accept' (or other acknowledgement) button, checkbox, or location for an electronic signature in the sequence of final pages before checkout.

A statement that confirmation of acceptance of terms and conditions is implied by submission of the order on the checkout screen near the 'submit' button.

Details of your delivery times for goods and services, which are to be appropriate for your type of business. (If delivery is to be delayed, the cardholder must be notified of the delay and an option provided to obtain a refund).

If applicable, details of any New Zealand export restrictions and legal restrictions.

If you bill a cardholder on a subscription basis in relation to an electronic commerce transaction, a statement that billing will occur on a monthly or other regular cyclical basis must appear on the page of your website used by the cardholder to communicate payment details.

Payment Choice - provide the customer with a clear choice of payment brands. Visa, MasterCard, and/or UnionPay full colour logos (of equal size) to indicate card acceptance and credential on file.

Card Security Code (CW2/CVC2/CVN2) - the payment page of your website must obtain the customer's card security code value for verification. For information security purposes merchants are prohibited from storing the Card Security Code.

Information Security - outline your site's security capabilities e.g. how card payment information is protected.

Credential on file is account information (including, but not limited to, an Account Number or Payment Token) that is stored by a merchant or its agent to process future transactions for a cardholder with cardholder consent. A merchant must display on the payment screen and all screens that show account information both:

The last 4 digits of the account number or token

The Card Schemes logo in full color.

Secure your page from potential miss use, by using Re-Captcha or similar, this will mitigate any unauthorised transaction attempts.

To further improve your security please talk to your account manager about implementing 3D Secure or Kount, both available as part of the Payrix Software suite.

PAYMENT WEBSITE BEST PRACTICE

Additional items that should be included on a merchant's website include:

Establish a clear, concise statement of your refund and credit policy including:

Make this statement available to website visitors through clearly visible links on your home page.

Provide 'click through' confirmation for important elements of the policy. For example, when purchasing tickets for a sporting event, customer should be able to click on a button - 'Accept' or 'I Agree' - to acknowledge that they understand that the tickets are non- returnable unless the event is postponed or cancelled.

Recurring Transactions

Clearly display your recurring transaction disclosure statement on the screen. Require the cardholder to 'click and accept' the disclosure statement to confirm that he or she has read it.

Customer Service Access

Provide an e-mail inquiry option. Your customers are likely to have questions or concerns regarding their online purchase. By offering your customers an easy way to contact you and by providing them with a prompt response, you can help avoid customer disputes and subsequent chargebacks.

Develop an e-mail inquiry response policy

Establish e-mail inquiry response standards and monitor staff compliance.

Offer local and toll-free telephone customer service support and display your phone numbers on your website.

Product Description, make sure your goods or services are accurately described on your website including:

Develop clear, complete product descriptions to reduce customer disputes and dissatisfaction over the actual product received versus what is described on your website.

Use product images and photos, if possible.

Further clarification of Delivery Policy

Clearly state any product or service delivery policy restrictions on your website. This is particularly important if you have geographic or other restrictions that may impact under what circumstances you will provide delivery.

Order fulfilment information, including:

State timeframes for order processing and send an e-mail confirmation and order summary within one business day of the original order

Provide up to date stock information if an item is backordered

Shipping

Develop a clear, comprehensive shipping policy and make it available to customers through a link on your home page and at the time of the online purchase.

Develop an e-mail response to inform customers of any goods or service delivery delays.

Consider not providing the tracking number if you are selling higher fraud risk merchandise and are not allowing redirection of the shipment. Online merchants have discovered fraudsters using the correct billing address and shipping to that address, then redirecting the merchandise. This practice could be applied selectively, based on merchandise type and amount.

Billing Practices

Develop a description of your billing practices terms and conditions and make them available to customers at the time of the online purchase, including:

Explain to customers when their credit cards will be billed.

If you use a billing service provider, let the customer know how the transaction will be reflected on their payment card statement (i.e., the service provider name and amount will be shown). This will reduce the risk of confusion when the statement arrives.

Encourage cardholders to retain a copy of the transaction.

Develop a clear, concise statement of your privacy policy and make it available to website visitors through links on your home page. This practice may be subject to legal requirements. To allay customer concerns about providing personal data, your privacy policy should define:

What customer data is collected and tracked

With whom this information is shared and

How customer can opt out

Additional Information Security

Create an FAQ page that includes questions and answers on how customers can protect themselves when shopping online

Discourage the use of e-mail of transactions

Digital Content Policies

Implement a policy that the cardholder will not be billed until the website service is actually accessed via the applicable password

Avoid the use of negative renewal options or other marketing techniques that may create a false expectation to cardholders around the product offering.

Ensure that all terms and conditions are clear and concise. Before a sale is conducted, you must clearly communicate any special restrictions to cardholders.

Payment page requirements - Payer Paid transaction fees

For Partners integrating their software to Payrix and are accepting payments via a non-Payrix Hosted Payment Page, your payment page will require the following to ensure it is compliant:

Any fees charged must be clearly displayed in dollar amounts on the payment page, the Direct Debit Request agreement (if offered) and the invoice. This ensure that the payer is fully aware of the fees associated with the transaction and protect the merchants from any disputes regarding the amount charged.

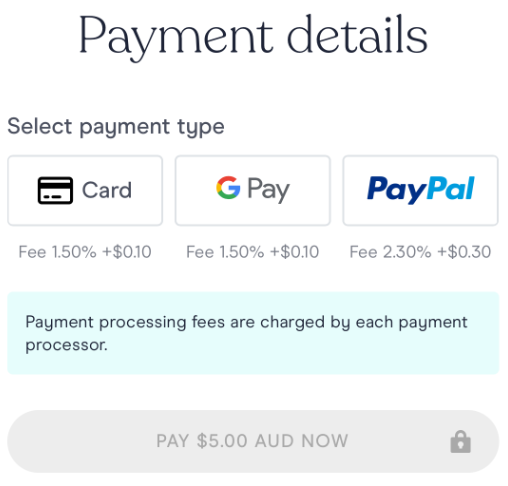

A sample of what the payment page could look like depending on the specific payment methods you are accepting are below:

In this example, the purchase amount is $5.00 and the transaction fees are displayed to the payer so they are aware of fees that are charged for the type of payment.

The total amount charged including the fees will need to be displayed on the next page the payer is directed to. The total amount charged including fees is returned via API if the payment is successful.

Should you have any questions around the payment page requirements, you can contact your Partner manager and we will provide guidance around the payment page requirements.